Behavioral finance is a field of study that combines insights from psychology and economics to understand how human behavior and cognitive biases influence financial decision-making. While traditional finance assumes that individuals are rational and always make choices that maximize their financial well-being, behavioral finance acknowledges that human beings are subject to various emotional and cognitive biases that can lead to less-than-optimal financial decisions. In this article, we will explore the role of behavioral finance in decision-making, its key concepts, and its impact on personal finances.

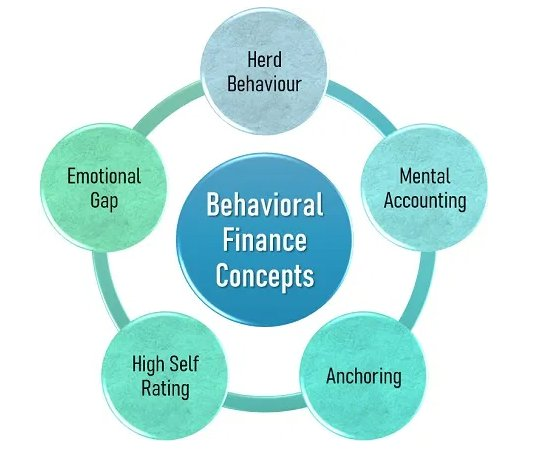

Key Concepts in Behavioral Finance

Loss Aversion: Loss aversion refers to the human tendency to strongly prefer avoiding losses over acquiring equivalent gains. In financial decision-making, people often take unnecessary risks to avoid recognizing a loss, even when it might be the rational choice.

Overconfidence: Overconfidence is a cognitive bias where individuals tend to overestimate their knowledge, skills, and the accuracy of their predictions. Overconfident investors may trade more frequently and believe they can consistently beat the market, which can lead to excessive risk-taking.

Anchoring: Anchoring is a cognitive bias where individuals rely too heavily on the first piece of information they receive (the “anchor”) when making decisions. This can lead to suboptimal decisions, especially in pricing and valuation.

Mental Accounting: Mental accounting is the tendency to treat money differently based on its source, purpose, or category. People may treat money differently when it comes from a windfall, salary, or a gift, even though it’s all fungible.

Herding Behavior: Herding behavior is the tendency of individuals to follow the crowd or make decisions based on what others are doing. This can lead to bubbles and market volatility.

Confirmation Bias: Confirmation bias is the tendency to search for, interpret, and remember information in a way that confirms one’s preexisting beliefs or hypotheses. Investors may ignore or discount information that contradicts their existing views.

Availability Heuristic: The availability heuristic is the tendency to overestimate the importance of information readily available and easily recalled. This can lead to biased decision-making based on recent, emotionally charged events.

Endowment Effect: The endowment effect is the tendency to assign a higher value to things simply because we own them. This can result in individuals holding onto investments or assets for longer than they should.

Sunk Cost Fallacy: The sunk cost fallacy is the tendency to continue investing in a project or decision based on the resources (time, money, effort) already invested, even if the future benefits are questionable. This can lead to poor financial decisions.

The Impact of Behavioral Finance on Decision-Making

Behavioral finance has a significant impact on personal financial decisions, often leading to suboptimal outcomes:

- Investment Choices: Behavioral biases can influence investment decisions, leading to overtrading, impulsive decisions, and a preference for familiar investments, even when better options are available.

- Risk Tolerance: Biases like loss aversion and overconfidence can impact an individual’s perception of risk, leading to either excessive risk-taking or an overly conservative approach, both of which can affect long-term financial goals.

- Savings and Spending: Behavioral biases can affect how individuals save and spend money. People may overspend due to a lack of self-control, make impulsive purchases, or fail to save adequately for the future.

- Debt Management: Behavioral biases can lead to poor debt management, such as taking on high-interest loans, not paying off credit card balances, and underestimating the consequences of debt.

- Retirement Planning: Behavioral biases can affect retirement planning, leading individuals to delay saving for retirement, make suboptimal investment choices, or underestimate their retirement needs.

- Emotional Decision-Making: Behavioral biases often lead to emotionally charged financial decisions, such as panic-selling during market downturns, making investment decisions based on fear or greed, and ignoring long-term financial plans in favor of short-term emotional reactions.

- Avoidance of Risk:

Behavioral biases may lead individuals to avoid risk altogether, even when taking calculated risks could lead to better financial outcomes, such as avoiding investment in the stock market altogether due to fear of loss.

Strategies for Mitigating Behavioral Biases

Understanding and mitigating behavioral biases is crucial for making more rational financial decisions. Here are some strategies to help mitigate the impact of behavioral biases:

- Education and Awareness: Learn about behavioral finance and recognize your own biases. Being aware of your biases is the first step in mitigating their impact.

- Objective Advisors: Seek advice from objective financial advisors who can provide rational, unbiased guidance. They can help you make informed decisions without being swayed by emotional biases.

- Set Clear Goals: Clearly define your financial goals and create a plan to achieve them. Having a roadmap for your financial journey can help you stay on track and avoid impulsive decisions.

- Diversify Investments: Diversification can help reduce the impact of individual investments on your portfolio. It can also mitigate the influence of cognitive biases on investment decisions.

- Embrace Long-Term Thinking: Focus on long-term financial goals and avoid reacting to short-term market fluctuations or emotional triggers.

- Use Automation: Automate your savings, investments, and bill payments to remove the need for regular, emotionally charged decisions.

- Consult Professionals: Consult with financial planners, therapists, or counselors who specialize in behavioral finance or emotional decision-making to address underlying issues that may contribute to financial biases.

- Keep Emotions in Check: Before making any significant financial decision, take a step back and evaluate your emotions. Are you making the decision based on fear, greed, or other emotions? Consider the rational factors involved.

Conclusion

Behavioral finance plays a substantial role in personal financial decision-making, often leading to suboptimal outcomes due to emotional and cognitive biases. Recognizing these biases, staying informed about behavioral finance concepts, and implementing strategies to mitigate their impact can help individuals make more rational, informed, and ultimately better financial decisions. By understanding the role of behavioral finance and addressing its influence, individuals can work toward achieving their financial goals and long-term financial security.